American life expectancy grew slightly in the last year, up to 79.25 years. As a result, planning to live a longer, healthier life is top of mind for many of us.

Studies show that embracing a healthy lifestyle can significantly impact the quality of our retirement years. Regular exercise, a balanced diet rich in nutrients, and staying mentally engaged can help maintain physical and cognitive function well into old age. But beyond just physical health, cultivating strong social connections and pursuing meaningful activities contribute to a fulfilling retirement.

To ensure your financial security aligns with your lifespan and health goals, let’s strategize. From optimizing your retirement savings to exploring long-term care insurance options, proactive planning can safeguard your finances at all stages of your life. Let’s continue this journey together, crafting a retirement plan that not only sustains your wealth but also supports your well-being.

For further insights on super-aging and financial planning, I encourage you to explore the articles below. Feel free to share them with friends and family to spark discussions on this crucial topic.

A Peek Inside the Brains of ‘Super-Agers’

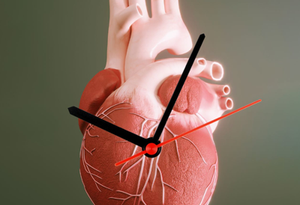

What Your ‘Heart Age’ Says About Your Health

May. 13, 2024

Do you need to know your heart age? A growing crop of tools will estimate it for you.

How to Invest Ahead of the 2024 Presidential Election

May. 9, 2024

Election Day in the U.S. is about six months away. Before voters head to the polls to cast their…

Five things to do if your investments aren’t working

May. 10, 2024

Reviewing your losers can help you notice patterns in your own investing style where you can…

Buffett’s 2024 Investment Wisdom: Psychology Matters As Much As Financials

May. 13, 2024

Value investors worship Warren Buffett. But his amazing investment success stems as much from his…

Social Security Is in Trouble—for Real. When to Claim Your Benefits.

May. 9, 2024

Many Americans worry about the future of Social Security, and rightly so. But that’s not a good…