With Labor Day behind us, the end of summer vacation time has officially arrived. Children have gone back to school and routines are shifting back to work mode, with the autumnal equinox just around the corner.

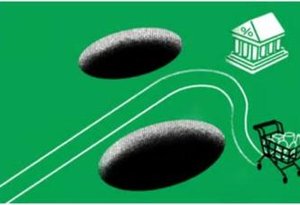

As we make this transition, you may have noticed that fewer young people are getting their driving licenses—a shift that is influencing their spending and lifestyle preferences. The increasing availability of ridesharing, improved public transportation, urban living trends, and high cost of car ownership are reducing the demand for personal vehicles.

This isn’t just influencing individual spending habits; it’s creating broader economic ripples, forcing automobile, insurance and retail industries to adapt. As fewer young people buy cars, a different financial landscape is taking shape that focuses more on shared services and digital connectivity than individual ownership.

Understanding these trends can not only help you anticipate market movements but also make more informed financial decisions, including investments that will benefit from related technological advances and shared economy mechanisms. As always, being well-informed is half the battle when managing your financial future, to which I hope these articles usefully contribute. Please share them with your family, friends or wider social network.

Remember, my door is always open if you have questions, concerns, or would like to reassess your financial plans as we transition into the cooler months.

Fewer Teens Want to Drive. It’s Changing How They Spend.

Aug. 20, 2024

What’s keeping young drivers off the road? High prices combined with other more viable options…

Why You Shouldn’t Try To Time The Market, Even During An Election Year

Aug. 30, 2024

Successfully leaving and reentering the market at the right times is nearly impossible, and…

On Warren Buffett’s 94th birthday, people shared his best investing advice

Why inflation fell without a recession

Americans Are Really, Really Bullish on Stocks

Sept. 3, 2024

The surging stock market has minted millionaires and helped send many Americans’ net worth…

It’s Back-To-School Season for Scammers, too—What to Watch Out for and How to Protect Yourself

Aug. 28, 2024

The FTC has issued an alert about scammers calling students and parents and pretending to be from…