Whether prompted by personal milestones, economic fluctuations, or unexpected life events, change is inevitable. In these moments, knowing when to reassess and reorder the priorities within your financial stratety becomes crucial.

Just as sailors adjust their sails to navigate through shifting winds, you should regularly reassess your financial priorities to ensure they align with your evolving life circumstances and financial situation.

Life’s twists and turns can be both exciting and challenging, often requiring a fresh perspective on how you manage your resources. For instance, receiving a promotion could open opportunities for increased savings or investment. Conversely, a sudden medical emergency might necessitate revisiting your emergency fund or insurance policies. Marriage, divorce, or the arrival of a child often means reshaping your budget and liability coverage to accommodate new family dynamics.

By regularly revisiting your goals and strategies, you can ensure that your strategy remains on course, supporting your aspirations amid life’s inevitable changes.

I’m here to help ensure your financial strategy is as prepared as possible for whatever life brings, so never hesitate to reach out to discuss what’s on your mind or let me know if there have been any changes that require us to make adjustments to it.

In the meantime, I hope you appreciate these articles and share them with family and friends.

How to Know When to Reorder Your Priorities—Ask These 2 Questions

Feb. 23, 2025

Wisdom pauses, asks more questions, considers, calibrates, compromises, and yes — wisdom changes…

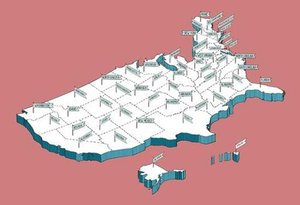

How long $1 million of retirement savings will take to run out in every U.S. state—it’s only 12 years in Hawaii

Feb. 21, 2025

Being a millionaire at retirement isn’t enough to survive for more than two decades in some U.S….

The Case for Getting Your Child a Retirement Account

Feb. 21, 2025

They say it’s never too early to start saving for retirement. How about birth?

Investors fear inflation is coming back. They may be right

Warren Buffett included 4 key pearls of wisdom in his annual shareholder letter

Feb. 24, 2025

There is perhaps no annual letter more anticipated than the one Warren Buffett sends to his…

The Market May Crash! Lifeboat Drills for Your Portfolio

Feb. 20, 2025

Just like practicing a lifeboat drill on a ship, envision what you’d do with your investments if…