The new tax, climate, and healthcare plan that President Biden signed into law last week aims to slow the pace of raging inflation and promises lower healthcare and energy costs down the line for families.

But the full impact of the new legislation on Americans’ finances is yet to be realized.

The following articles shed some light on how your taxes could be affected this year, what you can do now to prevent potential headaches or surprises next April, and some other useful and interesting information from this week. Know that I am closely monitoring the ongoing economic situation and can recommend potential changes to your strategy to help protect against inflation or a recession. Get in touch, and we can discuss.

I hope these articles inform and inspire you. Let me know if you have any questions or comments. I look forward to connecting with you soon.

The $80 Billion IRS Infusion Means More Audits—in 2026 or 2027

Aug. 22, 2022

The agency’s new funding will help fight tax cheats. IRS funding has been one of the most under-…

How The Inflation Reduction Act Could Lower Women’s Costs

Aug. 19, 2022

The new Inflation Reduction Act could save women in particular a lot of money on three…

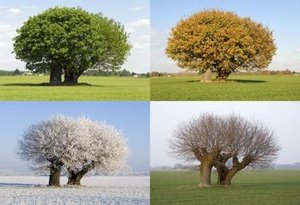

The Excitement and Anxiety of a New Start

Aug. 22, 2022

Transitions can be tough—here’s how to embrace them in this moment of change.

The Quantify-Everything Economy

Aug. 17, 2022

Data can make our lives richer, but let’s not forget that people are not machines.

Are You Too Responsible?

Aug. 22, 2022

Do you often pay attention to the needs of others but neglect your own? Do you frequently remind…

You Might Want to Do Your Holiday Shopping…Now

Aug. 23, 2022

Inventory surpluses are turning the typically slow sales season between back-to-school and the…